Keybot the Quant flips back to the short side yesterday, the last day of trading in 2022, at SPX 3803, and is now champing at the bit to go long again. If you blink it will probably change again. It is a whipsaw move after the quant flipped long on Thursday.

To begin 2023, the algo number is 9 points above the signal line so Keybot wants to flip long but cannot since the internal parameters will not fully latch as yet. If the SPX moves higher as trading begins on Tuesday, Keybot the Quant will likely flip long.

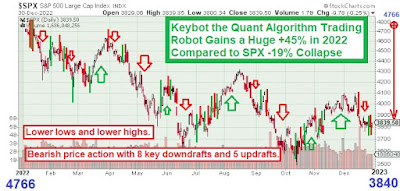

The SPX, the S&P 500, which is the United States stock market, folds like a cheap suit in 2022 losing -20.2% until the last hour of trading the index recovers +0.8% intraday to finish the year down -19.4%. Some jackasses like to use the silly -20% metric as the demarcation line for a bear market. Nonetheless, the market makers were not going to let 2022 close out that way so they pushed the jello around the plate on these days of thin trading to print the -19% number instead.

The Keybot the Quant algorithm program gains +30% in 2022 outperforming the benchmark SPX by 50 percentage points. The actual trading generated by Keybot the Quant gains a huge +45% in 2022 outperforming the US stock market by a humungous 65 percentage points. Keybot leaves the Wall Street hedge funds in the dust simply using 1's and 0's.

The flip to the short side yesterday after going long Thursday is a whipsaw so the quant is in the single 1x ETF mode until February to reduce risk in the chop-suey environment.

UTIL lost the 975 level a major bearish indication so watch this as soon as the opening bell rings on Tuesday. If UTIL remains below 975, the trap-door for stocks remains open and conditions will remain negative. If UTIL rises above 975, then 978.52, stocks will run strongly higher and this move to the upside likely has legs. Which outcome will occur?

If UTIL tags 975 heading higher, Keybot the Quant will likely flip long immediately.

Bears need XLF below 34.08 and NYA below 15111 to create stock market negativity and increased selling pressure.

If the SPX floats higher at the opening bell, Keybot the Quant will likely flip long but a gap-up move is not desired since that may delay the move to the long side by about 90 minutes. If UTIL moves above 975.30, Keybot the Quant will likely flip long immediately. If UTIL then moves above 978.52, stocks are going to rock and roll higher.

Bears simply need to keep the S&P futures negative on Tuesday morning, keep utes negative and then cut banks and the NYA index off at the knees. This would create blood and carnage on Wall Street.

Keybot the Quant is in SH the 1x ETF that moves higher if the SPX moves lower. The robot will remain in the 1x ETF's until February when the whipsaw timer expires. Keybot senses choppy slop price action ahead so it drops down into the single ETF trading vehicles to reduce risk.

Keybot the Quant prints one pre-scheduled number this week on Friday morning. Keybot is on a roll for many years. Will the big effortless money-making party continue? It should since the robot was designed in a way that others cannot repeat its methods. Keybot does not play well with others. Let the 2023 festivities begin.

1/8/23;

7:00 PM EST =

1/6/23;

9:00 AM EST =

1/1/23; Begin

2023 Data = -16; signal line is -25; go short 3840; (Benchmark SPX for

2023 = +0.0%)(Keybot algo this trade = +0.0%; Keybot algo for 2023 =

+0.0%)(Actual results this trade = +0.0%; Actual results for 2023 = +0.0%)

Keybot the

Quant Begins 2023 on the Short Side from SPX 3840

All Data 0%.

Begin 2023

-------------------------------------------------------------------------------

START 2023 PROGRAM

Begin Printing

Mark and Set

Date Stamp 12/31/22;

8:37 AM EST

START 2023 PROGRAM

Copyright Enforced.

2008. 2009. 2010. 2011. 2012. 2013. 2014. 2015. 2016. 2017. 2018. 2019. 2020.

2021. 2022. 2023. Keybot the Quant. The Keystone Speculator. K E Stone. All

Rights Reserved.

End – End – End – End –

End – End – End – End – End – End – End

--------------------------------------------------------------------------------

END OF 2022

RESULTS:

The SPX

(S&P 500) Benchmark Index Loses -19.4% in 2022

(SPX Started

at 4766 and Ended at 3840 Collapsing 926 Points Preventing a -20.2% Loss for

the Year During the Final Hour of Trading in 2022)

Keybot

the Quant Algorithm (Computer Program Only) During 2022: +29.8%

KEYBOT

THE QUANT ACTUAL TRADING RETURN FOR 2022 INCLUDING ALL COMMISSIONS, COSTS AND

FEES: +44.5%

Keybot the Quant has never printed a

losing year

Keybot the Quant is a long-short

algorithm that oscillates between a bullish (long) position and a bearish

(short) position seeking the smoothest path through the trading year using the

S&P 500 (SPX; the US stock market) as the benchmark comparison index

Number of

Position Changes (Long to Short or Short to Long) During 2022: 37

|

1/1/2022

|

4766

|

Go

Long

|

6:11

AM

|

SPY

|

474.96

|

|

1/10/2022

|

4630

|

Sell

Long

|

9:36

AM

|

SPY

|

467.42

|

|

1/10/2022

|

4630

|

Go

Short

|

9:36

AM

|

SH

|

13.83

|

|

1/11/2022

|

4679

|

Cover

Short

|

11:28

AM

|

SH

|

13.86

|

|

1/11/2022

|

4679

|

Go

Long

|

11:28

AM

|

DIA

|

360.15

|

|

1/13/2022

|

4660

|

Sell

Long

|

3:50

PM

|

DIA

|

360.96

|

|

1/13/2022

|

4660

|

Go

Short

|

3:50

PM

|

DOG

|

31.86

|

|

2/1/2022

|

4533

|

Cover

Short

|

3:22

PM

|

DOG

|

32.50

|

|

2/1/2022

|

4533

|

Go

Long

|

3:22

PM

|

QQQ

|

363.93

|

|

2/10/2022

|

4542

|

Sell

Long

|

9:36

AM

|

QQQ

|

361.35

|

|

2/10/2022

|

4542

|

Go

Short

|

9:36

AM

|

SDS

|

38.32

|

|

2/15/2022

|

4461

|

Cover

Short

|

9:43

AM

|

SDS

|

39.61

|

|

2/15/2022

|

4461

|

Go

Long

|

9:43

AM

|

SSO

|

63.86

|

|

2/17/2022

|

4420

|

Sell

Long

|

9:55

AM

|

SSO

|

62.69

|

|

2/17/2022

|

4420

|

Go

Short

|

9:55

AM

|

SDS

|

40.30

|

|

2/25/2022

|

4332

|

Cover

Short

|

10:45

AM

|

SDS

|

41.80

|

|

2/25/2022

|

4332

|

Go

Long

|

10:45

AM

|

QLD

|

64.81

|

|

3/14/2022

|

4185

|

Sell

Long

|

12:56

PM

|

QLD

|

56.08

|

|

3/14/2022

|

4185

|

Go

Short

|

12:56

PM

|

SDS

|

44.29

|

|

3/16/2022

|

4314

|

Cover

Short

|

9:36

AM

|

SDS

|

41.63

|

|

3/16/2022

|

4314

|

Go

Long

|

9:36

AM

|

SPY

|

430.81

|

|

3/31/2022

|

4540

|

Sell

Long

|

3:59

PM

|

SPY

|

458.76

|

|

3/31/2022

|

4540

|

Go

Short

|

3:59

PM

|

SH

|

13.87

|

|

4/19/2022

|

4420

|

Cover

Short

|

9:54

AM

|

SH

|

14.43

|

|

4/19/2022

|

4420

|

Go

Long

|

9:54

AM

|

SSO

|

62.31

|

|

4/21/2022

|

4453

|

Sell

Long

|

12:13

PM

|

SSO

|

63.25

|

|

4/21/2022

|

4453

|

Go

Short

|

12:13

PM

|

SDS

|

38.60

|

|

5/27/2022

|

4127

|

Cover

Short

|

11:43

AM

|

SDS

|

43.41

|

|

5/27/2022

|

4127

|

Go

Long

|

11:43

AM

|

SSO

|

53.77

|

|

6/1/2022

|

4103

|

Sell

Long

|

10:39

AM

|

SSO

|

53.13

|

|

6/1/2022

|

4103

|

Go

Short

|

10:39

AM

|

SDS

|

43.85

|

|

6/2/2022

|

4102

|

Cover

Short

|

10:17

AM

|

SDS

|

43.90

|

|

6/2/2022

|

4102

|

Go Long

|

10:17

AM

|

SPY

|

409.73

|

|

6/9/2022

|

4078

|

Sell

Long

|

2:41

PM

|

SPY

|

407.56

|

|

6/9/2022

|

4078

|

Go

Short

|

2:41

PM

|

SH

|

15.41

|

|

7/1/2022

|

3822

|

Cover

Short

|

3:33

PM

|

SH

|

16.34

|

|

7/1/2022

|

3822

|

Go

Long

|

3:33

PM

|

DIA

|

310.70

|

|

7/5/2022

|

3760

|

Sell

Long

|

9:36

AM

|

DIA

|

305.82

|

|

7/5/2022

|

3760

|

Go

Short

|

9:36

AM

|

SH

|

16.60

|

|

7/6/2022

|

3856

|

Cover

Short

|

3:12

PM

|

SH

|

16.19

|

|

7/6/2022

|

3856

|

Go

Long

|

3:12

PM

|

QQQ

|

289.96

|

|

7/12/2022

|

3831

|

Sell

Long

|

3:02PM

|

QQQ

|

287.05

|

|

7/12/2022

|

3831

|

Go

Short

|

3:02PM

|

DOG

|

35.87

|

|

7/15/2022

|

3855

|

Cover

Short

|

10:33

AM

|

DOG

|

35.69

|

|

7/15/2022

|

3855

|

Go

Long

|

10:33

AM

|

SPY

|

384.07

|

|

7/26/2022

|

3926

|

Sell

Long

|

11:28

AM

|

SPY

|

391.65

|

|

7/26/2022

|

3926

|

Go

Short

|

11:28

AM

|

RWM

|

24.53

|

|

7/27/2022

|

3959

|

Cover

Short

|

9:36

AM

|

RWM

|

24.37

|

|

7/27/2022

|

3959

|

Go

Long

|

9:36

AM

|

SPY

|

391.47

|

|

8/26/2022

|

4064

|

Sell Long

|

3:56

PM

|

SPY

|

404.89

|

|

8/26/2022

|

4064

|

Go

Short

|

3:56

PM

|

SDS

|

43.00

|

|

9/7/2022

|

3944

|

Cover

Short

|

11:25

AM

|

SDS

|

45.60

|

|

9/7/2022

|

3944

|

Go

Long

|

11:25

AM

|

SSO

|

48.38

|

|

9/13/2022

|

3987

|

Sell

Long

|

10:56

AM

|

SSO

|

49.34

|

|

9/13/2022

|

3987

|

Go

Short

|

10:56

AM

|

SDS

|

44.43

|

|

10/13/2022

|

3620

|

Cover

Short

|

11:20

AM

|

SDS

|

53.50

|

|

10/13/2022

|

3620

|

Go

Long

|

11:20

AM

|

SSO

|

40.36

|

|

10/20/2022

|

3661

|

Sell

Long

|

2:12

PM

|

SSO

|

41.18

|

|

10/20/2022

|

3661

|

Go

Short

|

2:12

PM

|

SDS

|

51.68

|

|

10/21/2022

|

3742

|

Cover

Short

|

2:09

PM

|

SDS

|

49.42

|

|

10/21/2022

|

3742

|

Go

Long

|

2:09

PM

|

SPY

|

373.25

|

|

11/1/2022

|

3854

|

Sell

Long

|

10:47

AM

|

SPY

|

382.85

|

|

11/1/2022

|

3854

|

Go

Short

|

10:47

AM

|

SH

|

16.08

|

|

11/7/2022

|

3809

|

Cover

Short

|

3:16

PM

|

SH

|

16.20

|

|

11/7/2022

|

3809

|

Go

Long

|

3:16

PM

|

SPY

|

380.09

|

|

11/9/2022

|

794

|

Sell

Long

|

10:39

AM

|

SPY

|

378.68

|

|

11/9/2022

|

3794

|

Go

Short

|

10:39

AM

|

SH

|

16.26

|

|

11/10/2022

|

3876

|

Cover

Short

|

9:36

AM

|

SH

|

15.91

|

|

11/10/2022

|

3876

|

Go

Long

|

9:36

AM

|

QQQ

|

275.46

|

|

12/15/2022

|

3934

|

Sell

Long

|

9:36

AM

|

QQQ

|

281.00

|

|

12/15/2022

|

3934

|

Go

Short

|

9:36

AM

|

SDS

|

43.90

|

|

12/29/2022

|

3838

|

Cover

Short

|

10:12

AM

|

SDS

|

46.01

|

|

12/29/2022

|

3838

|

Go

Long

|

10:12

AM

|

SSO

|

44.41

|

|

12/30/2022

|

3803

|

Sell

Long

|

1:26

PM

|

SSO

|

43.62

|

|

12/30/2022

|

3803

|

Go

Short

|

1:26

PM

|

SH

|

16.17

|

|

12/31/2022

|

3840

|

Cover

Short

|

8:37

AM

|

SH

|

16.03

|

Date – SPX – Position –

Time Stamp – ETF – Price

Begin Printing Trade

Data Entries Exits Reverse Order

FINAL 2022 RESULTS

Mark and Set

Date Stamp 12/31/22;

8:37 AM EST

End – End – End – End –

End – End – End – End – End – End – End

-----------------------------------------------------------------------------------

12/31/22;

Algorithm Zeroed for 2023 Data EOM EOQ4 EOH2 EOY2022 = -16; signal line is -25;

go short 3840; (Benchmark SPX for 2022 Final = -19.4%)(Keybot algo this

trade = -1.0%; Keybot algo for 2022 Final = +29.8%)(Actual results this trade =

-0.9%; Actual results for 2022 Final = +44.5%)

12/30/22; 3:36 PM EST =

-16; signal line is -26 but algorithm remains short

12/30/22; 3:17 PM EST =

-32; signal line is -27

12/30/22; 1:26

PM EST = -46; signal line is -27; go short 3803; (Benchmark SPX for 2022

= -20.2%)(Keybot algo this trade = -0.9%; Keybot algo for 2022 = +30.8%)(Actual

results this trade = -1.8%; Actual results for 2022 = +45.4%)

12/30/22; 1:25 PM EST =

-32; signal line is -26 but algorithm remains long

12/30/22; 9:50 AM EST =

-16; signal line is -27

12/29/22;

10:12 AM EST = +0; signal line is -27; go long 3838; (Benchmark SPX for 2022 = -19.5%)(Keybot

algo this trade = +2.4%; Keybot algo for 2022 = +31.7%)(Actual results this

trade = +4.8%; Actual results for 2022 = +47.2%)